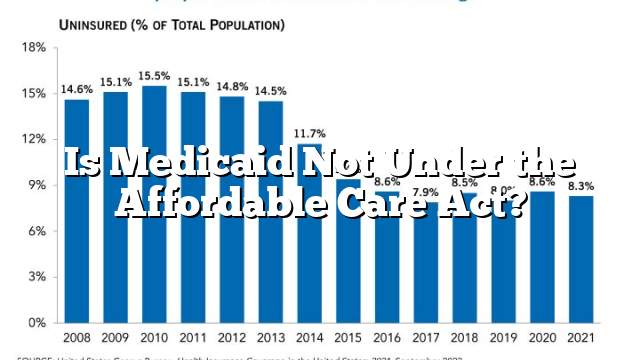

As soon as a Medicare beneficiary enrolls, any attempt by anyone else to sell them an Affordable Care Act marketplace plan will likely cease automatically.

Many people with Affordable Care Act plans receive subsidies that help pay their premiums, deductibles and copays. Once Medicare takes effect and these subsidies end.

Preventive Care

Under Obamacare (or Affordable Care Act), most health plans must cover preventive services without charging you a copayment or coinsurance, such as screenings and immunizations. Preventive care helps people remain healthy by helping identify diseases early, and treating them before they become more serious.

In March 2023, a federal judge overturned parts of the Affordable Care Act’s preventive care coverage requirement, but this ruling remains on hold while it’s reviewed in US Court of Appeals. If upheld, however, this ruling should have no impact on existing coverage since health plans typically offer policies lasting one or more years.

The Affordable Care Act mandates that most private health plans provide preventive services recommended by the U.S. Preventive Services Task Force, the Advisory Committee on Immunization Practices, and Health Resources and Services Administration’s Bright Futures guidelines for children from birth through age 21 including zero cost female contraception coverage. These requirements apply both individually insured plans as well as those offered through Marketplace plans (with certain “grandfathered” plans being exempt).

The Donut Hole

Medicare Part D covers prescription drug costs for its enrollees. Many enroll in this plan to help with these costs; however, until recently enrolled would reach what was known as the “donut hole.” This gap appears once your plan has spent a certain amount on medication; the Affordable Care Act reduced this gap through discounts from drug manufacturers.

In 2019, this gap was closed (earlier than planned) for brand-name medications, with generics closing soon thereafter. Under this new phase of drug coverage, your plan will cover most of the cost associated with your medications to ensure long-term access, leaving only 25% to be covered through coinsurance or nominal copay payments after reaching your deductible threshold.

Coinsurance and Deductibles

The Affordable Care Act (ACA) sets forth a maximum out-of-pocket cost threshold that an individual can incur during any policy period, which may include deductibles, copayments and coinsurance amounts. These charts offer information about deductibles and cost sharing in plans sold on the health insurance marketplace as well as their actuarial values – an essential metric that allows consumers to compare quality across plans while helping enrollees identify plans with lower deductibles as well as cost assistance options that might be available for them.

Original Medicare provides hospital and medical coverage, but not all services or supplies are covered by it. Therefore, it is essential that you speak to your doctor about which services or supplies are necessary and whether Medicare can cover them before considering other options such as Medicare Advantage Plans (Part C) which offer additional benefits and Medicare Supplement (Medigap) plans which fill any gaps left by Original Medicare.

Special Enrollment Periods

The Affordable Care Act permits individuals to make adjustments to their private health coverage outside of an annual open enrollment period if certain life events arise, such as moving, having a baby and/or losing other health coverage (i.e. job loss or Medicaid/MinneapolisCare loss). You have up to 60 days within each special enrollment period in which to select a new plan.

Documentary evidence must be presented in order to qualify for a special enrollment period and financial assistance may depend upon factors like income and household size.

But due to a recent federal rule change, special enrollment periods have now become available year-round for low-income people to sign up for Marketplace coverage with subsidies. For more information about this service and comparing plans and costs side-by-side as well as estimating subsidy eligibility visit ACA Marketplace website.