Medicaid is a program that offers health insurance to low-income Americans. Most Americans who qualify for this coverage must pay their premiums, but many also receive financial assistance to reduce expenses.

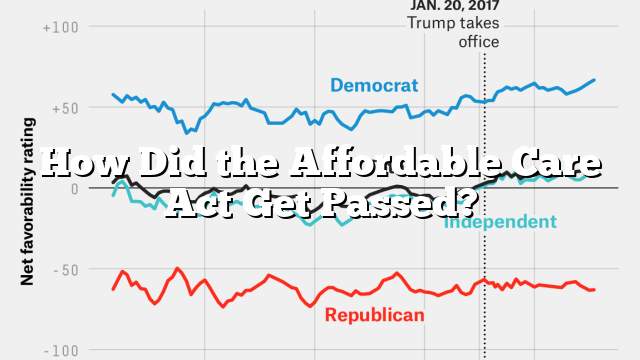

The Affordable Care Act (ACA) extended Medicaid eligibility to millions of low-income people across many states, and studies have demonstrated that this coverage has led to improved health and educational outcomes for some beneficiaries.

Benefits

The Affordable Care Act has brought about numerous advantages for those who gain health insurance coverage and their families, as well as states that have expanded Medicaid. Notable among these outcomes are improved health outcomes and higher human capital formation in both the short and long run.

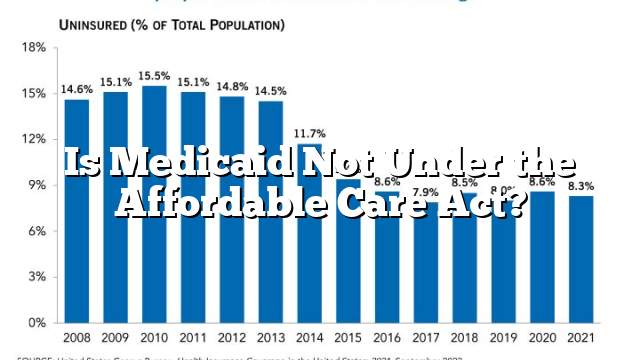

The Affordable Care Act’s Medicaid expansion has significantly reduced racial disparities in health coverage and access to care, particularly among adults. Since 2014 when these major coverage provisions took effect, uninsured rates between white and Black adults shrank by 51 percent (versus 33%) while Hispanic adults saw their uninsured rates drop by 45 percent (versus 27%) in expansion states versus non-expansion ones).

The Affordable Care Act further strengthened financial security for low-income people through expanded eligibility for Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF). Furthermore, a provision in the ACA grants states an increase of 5 percentage points in their base Federal Medical Assistance Percentage (FMAP) when expanding Medicaid coverage.

Eligibility

Medicaid eligibility for most children, pregnant women, parents and adults was altered to a new methodology using Modified Adjusted Gross Income (MAGI). This allows states to utilize one set of income counting rules and one application across programs.

However, some individuals are exempt from MAGI-based income counting rules or may have their eligibility determined differently than MAGI. Examples include people 65 and older or those with blindness/disability who qualify for Supplemental Security Income (SSI) under the Social Security Act as well as beneficiaries of Medicare Savings Programs.

In general, to qualify for Medicaid coverage, an individual must have no countable assets that exceed a specified limit and meet other financial eligibility criteria. This includes having income below the federal poverty level (FPL) and meeting any cost-sharing limits, if applicable.

Costs

The Affordable Care Act (ACA) has brought health insurance to more Americans through state marketplaces and Medicaid expansion. Furthermore, it’s made it more affordable for many low-income Americans to acquire subsidized exchange coverage through tax credits and cost-sharing reductions.

Medicaid is a federal-state collaboration that provides health coverage to over 50 million low-income adults in America. Through the Affordable Care Act (ACA), eligibility was extended beyond disabled individuals to non-disabled people whose incomes fell below 138% of the poverty level – $18,700 for an individual.

Expansion states have experienced greater decreases in their uninsured rate and uncompensated care costs than non-expansion states.

Additionally, expanding access to insurance has provided low-income renters with greater financial stability. This could result in fewer evictions and fewer moves among family members.

Despite these advantages, some may find the cost of a basic plan with high out-of-pocket maximums prohibitive. This is particularly true for older adults and children.

Taxes

The Affordable Care Act (ACA) introduces several new taxes that disproportionately affect low income families and individuals. These fees include the Medicare payroll tax and brand-name drug tax.

ACA Penalties: Businesses may face additional expenses and penalties if they don’t offer health insurance or one of their employees qualifies for a premium subsidy. These assessments are based on a firm’s size, number of full-time equivalent employees, and whether any receive subsidies when purchasing insurance through the marketplace.

Another tax that may impact small business is the Affordable Care Act’s Cadillac Tax on high-cost health plans. This tax is index to general inflation so it’s expected to rise annually.

People with higher incomes must pay an additional 0.9% Medicare tax in addition to their regular contributions. The income threshold for this tax is $250,000 for individuals or $250,000 jointly.