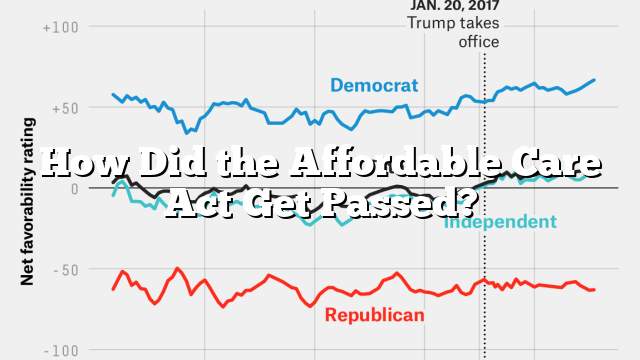

The Affordable Care Act (ACA), commonly referred to as “Obamacare,” is a sweeping health care reform law that President Barack Obama signed into law in 2010.

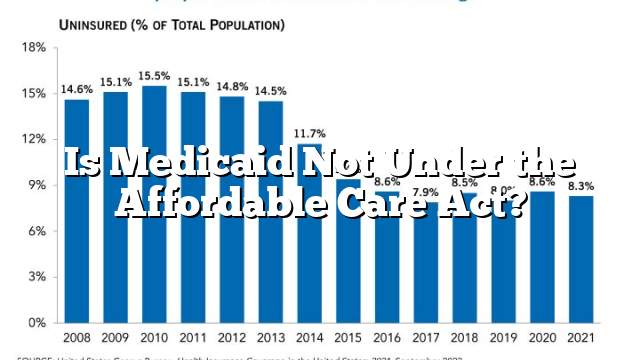

The law aims to extend coverage to millions of uninsured Americans, make a series of reforms designed to lower costs and improve system efficiency, and end practices such as pre-existing condition discrimination. The ACA also makes public health investments.

The Patient Protection and Affordable Care Act (PPACA)

The Patient Protection and Affordable Care Act (PPACA), also known as “Obamacare,” was signed into law by President Obama on March 23, 2010. This comprehensive healthcare reform law significantly changes the way millions of Americans receive health care coverage.

PPACA provides numerous rights and protections for consumers, along with subsidies (through “premium tax credits”) to help make insurance more affordable. It also expands the Medicaid program to cover more people with low incomes.

Various provisions of PPACA may have impacts on the state tax system and revenues. Additionally, they may have implications for state employee and retiree benefits.

The Health Insurance Marketplace

The Health Insurance Marketplace is a portal for individuals, families, and small businesses to shop for private health coverage. The Marketplace was created by the Affordable Care Act (ACA) and serves as a gateway to health coverage.

The Marketplace provides essential benefits, such as doctor visits, preventive services, hospitalization and prescriptions. It also allows you to compare plans based on cost, benefits and quality.

You can choose from four plan categories: Platinum, Gold, Silver and Bronze. Each plan category has different premiums and out-of-pocket costs.

If you have a preexisting condition, you may be eligible for extra savings called cost-sharing reductions. These reduce your out-of-pocket costs, such as copays and deductibles.

The Affordable Care Act’s Taxes

The Affordable Care Act enacted several tax provisions that impact individuals, families, businesses, insurers, and other organizations. These taxes have important implications for health care reform and the distribution of after-tax income in the United States.

Premium Tax Credits

The ACA instituted a refundable tax credit to help low-income individuals and families pay for health insurance. The credit primarily benefits those with incomes between 100 and 400 percent of the federal poverty level.

It also provides a tax credit for small employers to purchase coverage for their employees. Employers must have fewer than 25 full-time workers with average wages of less than $50,000 to qualify for the tax credit.

The ACA also imposed a healthcare tax on high-cost health plans. This is referred to as the healthcare insurance tax or HIT. It costs insurance providers and consumers an estimated $16 billion in fees, or roughly 2.2 percent of premiums, over the next decade.

The Patient Protection and Affordable Care Act’s Regulations

The Patient Protection and Affordable Care Act was implemented on March 23, 2010. Its main purpose is to expand coverage, control costs, and improve health care quality. The law contains new taxes, spending cuts, and mandates that affect many programs.

The law requires most Americans to obtain health insurance or pay a tax penalty. It also sets up a federal high-risk health insurance pool program.

PPACA requires insurance companies to cover a wide range of medical conditions, prohibits pre-existing condition exclusions, and limits waiting periods. It also requires companies to spend at least 85 percent of premiums on claims or refund the difference to enrollees.

The law allows physicians and other health providers to establish Accountable Care Organizations (ACOs), which can contract directly with Medicare to share in the savings and quality improvements achieved while lowering cost. These collaborations can include physician groups, networks of individual practices, partnerships and joint venture arrangements, hospitals that employ accountable care professionals, or other arrangements approved by the HHS Secretary.